"Money and Trade Considered" by John Law is a treatise on economic theory written in the early 18th century. This work delves into the nature of money, trade, and the measures needed to address the scarcity of money in the nation. Law discusses various economic concepts such as the valuation of goods, the principles of barter, and the pivotal role of silver as currency, ultimately laying the groundwork for his proposals on monetary reform. The opening of the text outlines Law’s objective to investigate the concepts of money and trade, presenting a clear rationale for why silver was historically favored as a form of currency. He begins by discussing the nature of value in trade, emphasizing that the value of goods depends on their utility and rarity, and illustrates how trade was conducted through barter before the adoption of money. Law highlights the deficiencies of barter, such as the difficulty in finding suitable exchanges, and gradually develops his argument for the necessity of a stable monetary system anchored by silver to facilitate trade and enhance economic prosperity. (This is an automatically generated summary.)

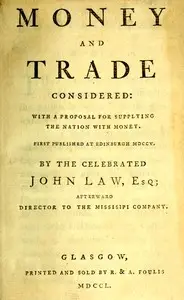

Money and trade considered : $b With a proposal for supplying the nation with money

By John Law

"Money and Trade Considered" by John Law is a treatise on economic theory written in the early 18th century. This work delves into the nature of money...

John Law was a Scottish-French economist who distinguished money, a means of exchange, from national wealth dependent on trade. He served as Controller General of Finances under the Duke of Orleans, who was regent for the juvenile Louis XV of France. In 1716, Law set up a private Banque Générale in France. A year later it was nationalised at his request and renamed as Banque Royale. The private bank had been funded mainly by John Law and Louis XV; three-quarters of its capital consisted of government bills and government-accepted notes, effectively making it the nation's first central bank. Backed only partially by silver, it was a fractional reserve bank. Law also set up and directed the Mississippi Company, funded by the Banque Royale. Its chaotic collapse has been compared to the 17th-century tulip mania parable in Holland. The Mississippi bubble coincided with the South Sea bubble in England, which allegedly took ideas from it. Law was a gambler who would win card games by mentally calculating odds. He propounded ideas such as the scarcity theory of value and the real bills doctrine. He held that money creation stimulated an economy, paper money was preferable to metal, and dividend-paying shares a superior form of money. The term "millionaire" was coined for beneficiaries of Law's scheme.